Final Expense Insurance

Call NowWhat to Know About Final Expense Insurance

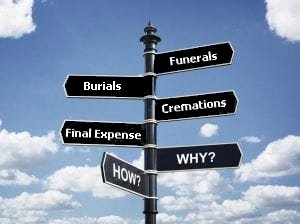

Before looking into Final Expense Insurance like Funeral, Burial, and Cremation Insurance, it’s important to understand what this term means. As a result of your research, you may see burial insurance referred to as funeral insurance, final expense insurance, cremation insurance, or even senior life insurance. Also, it’s very possible that you have seen commercials for these kinds of products on TV or on the internet. As such, all of the different names for funeral or burial insurance refer to a certain kind of life insurance policy that has been designed and tailored for seniors and family members to use to pay for final expenses when an insured loved-one passes away.

To clarify, Final Expense Insurance requires answering a limited amount of easy health questions. In addition, some policies, which guarantee approval, do not have any health-related questions.

Comparison

When comparing Funeral, Burial, and Cremation insurance with typical life insurance, one sees Life Insurance as costing much more. Firstly, we believe that a Funeral, Burial, and Cremation Insurance policy provides a cost-effective method of paying for a very expensive funeral that everyone should have. Because of this position, we want to provide knowledge and facts to those interested in learning more about this insurance. Finally, we are the experts with the knowledge, skills, and abilities to lay out the facts and costs to you with absolutely NO OBLIGATION.

In conclusion, why not contact us by phone or email?

To sum it up, it would be our pleasure to provide you with the facts and valuable information regarding a Final Expense Insurance policy covering Funerals, Burials, and Cremations Insurance policy. Therefore, please give us a call.

Therefore, fill out the form on the right side of the screen and we will give you a Free Funeral and Memorial Planning Guide, and a very knowledgeable Insurance professional will contact you to answer any questions.